Provide more value to your customers

Grow your business with our effective credit model

The only app that gets your money into shape

Manage money on the go in the app

Qualify for a loan within 6 months

You can qualify for a loan provided that you:

- Manage a good record of purchases/invoices on the app

- Manage your sales on the app

- Update your inventory on the app

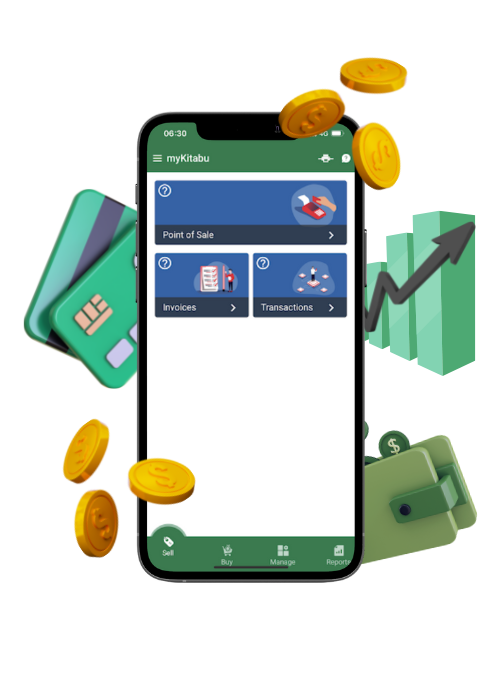

Manage your entire operation

at your fingertips

Easy to use

The Data Collection Tool has a very user-friendly interface. Navigate around and complete tasks with ease.

Fast

Business tasks can be done in an instant. From payments to generating reports. Speed is key.

No Wifi required

Users are able to use the application offline and it automatically syncs the new data the moment they are connected to the internet.

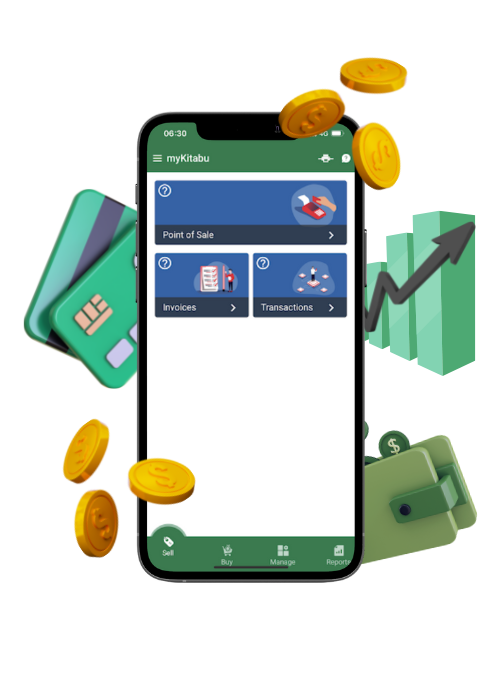

Manage your entire operation

at your fingertips

Easy to use

The Data Collection Tool has a very user-friendly interface. Navigate around and complete tasks with ease.

Fast

Business tasks can be done in an instant. From payments to generating reports. Speed is key.

No Wifi required

Users are able to use the application offline and it automatically syncs the new data the moment they are connected to the internet.

The perfect features for you

More than 25 modules, including: sales, purchaseing, accounting, inventory, reports, CRM, HR, payroll, projects etc.

The perfect features for you

More than 25 modules, including: sales, purchaseing, accounting, inventory, reports, CRM, HR, payroll, projects etc.

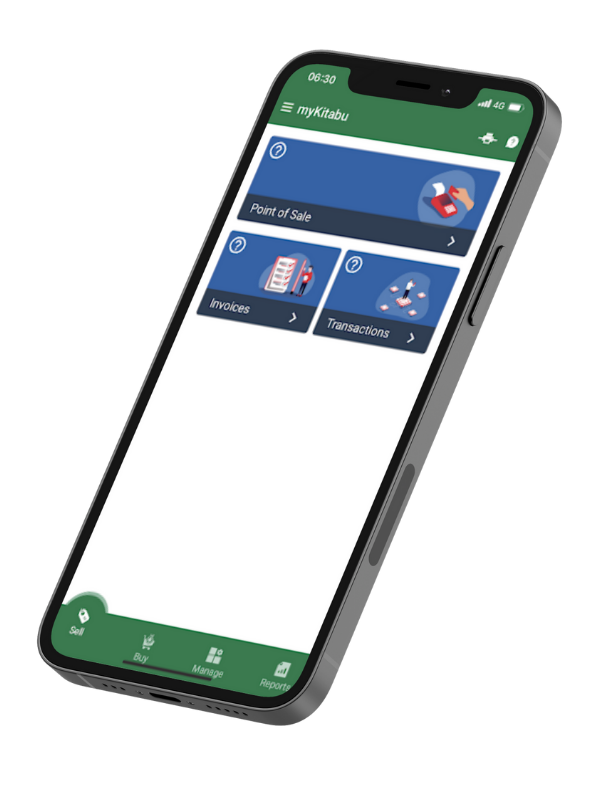

Sell

- Allows the user to sell products and pay immediately through the built-in POS.

- The system automatically calculates excess cash collected and the change to be returned to the customer.

- Creates invoices and records payments later for customers.

Buy

- Vendor Bills- manages purchasing products.

- Expense helps user to control expense incurred (such as: Rent, Salaries, Mobile Bill,… and so on)

Manage

- Create, edit, delete and upload images for customer and vendor.

- Easy to create new products.

- Choose product type and category.

- Update price, cost, and quantity of product.

Report

- Shows the revenue statistics and the quantity of goods sold daily, weekly, monthly, and quarterly in both POS and Sales

Ready to start?

contact us